An FHA-insured home loan delivers several advantages-- however might have some downsides, too. Rate lock-in supplies vary by lending institution, yet they generally can be found in 30-, 45-, 60- and even 90-day durations. This number stands for how long your price is locked in and assured for.

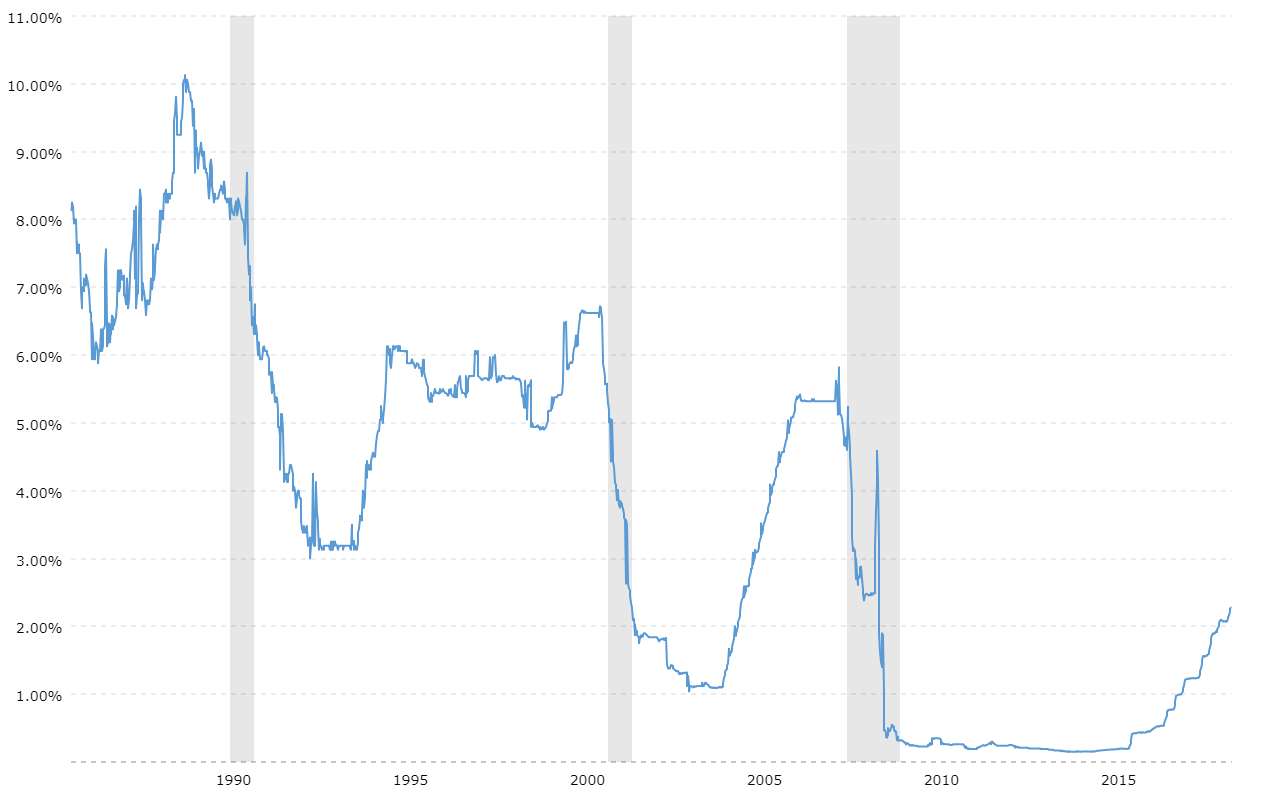

To discover what rates are currently readily available, contrast quotes from several loan providers. Your home mortgage rates of interest influences the amount you'll pay month-to-month along with the total rate of interest expenses you'll pay over the life of your finance. While it might not seem like a great deal, a reduced rate of interest also by fifty percent of a percent can amount to significant cost savings for you. Although home chelsea financial group inc loan rates fluctuate daily, 2020 as well as 2021 were years of record lows for home mortgage and re-finance rates throughout the US. Your loan provider will check out your credit rating to assess just how most likely you are to pay back the loan. You must strive a rating of at least 620 to get approved for a conventional home mortgage.

Yet if your score remains in the 580 to 620 variety, an FHA funding is likely your best choice. " FHA improve is a kind of a restricted cash-out, which is the same as a rate-and-term re-finance," Hell explains. The typical 30-year dealt with FHA mortgage APR is 3.660%, according to Bankrate's newest study of the country's largest refinance lending institutions.

- When you're purchasing prices, you ought to discover all your alternatives and pay attention to the expense of mortgage insurance along with your home loan rate.

- The viewpoints timeshare org revealed are the writer's alone and have actually not been supplied, authorized, or otherwise recommended by our partners.

- If you have lower credit report and also a reduced down payment, a car loan guaranteed by the Federal Real estate Management may assist you with your homebuying goals.

- The home mortgage APRis the interest rate plus the prices of things like discount factors andfees.

. The FHA car loan classification started in the 1930s to boost house sales. The united state federal government doesn't make the car loans, but however instead insures them. Cardinal Financial Firm, also known as Sebonic Financial, provides refinancing for conventional as well as government-insured financings, including FHA streamline refinances. A significant component of APR is home mortgage insurance coverage-- a plan that protects the loan provider from losing cash if you default on the home mortgage. APR is a device used to contrast finance deals, even if they have various rate of interest, fees and price cut factors.

Fha Loan Programs

So picking the 15-year FHA mortgage is a great means to conserve cash-- but just if you can manage it. Mortgage insurance coverage costs or 'MIP' is called for on all FHA fundings. It costs 1.75% of the financing quantity upfront and also 0.85% annually. This effectively enhances the price you're paying by almost a full portion point. If you have actually confirmed you're a great credit scores danger for your existing FHA loan, there's no need for a new debt-to-income ratio calculation.

When Should I Refinance An Fha Financing?

Mortgage prices transform consistently, so the repaired price they're provided in 5 years might be more than the one they can secure today. Belongs to the Home Mortgage Proving Ground, LLC, (" MRC") Network. MRC is an exclusive business that provides home loan details and connects buyers with lenders.

Just How Do I Discover The Most Effective Home Loan Price?

A quantity paid to the loan provider, usually at closing, in order to decrease the rates of interest. One point amounts to one percent of the car loan quantity (for example, 2 points on a $100,000 home mortgage would amount to $2,000). If you're questioning what occurs to your rate after you close, however, that option is up to you. Most borrowers go with a fixed-rate car loan, which is specifically what it sounds like-- your interest rate remains the very same for the life of the lending. The riskier the loan appears for the loan provider, the greater the price will be.